Unlock Savings: Your Easy Guide to Understanding Credit Card Interest Rates

Ever wondered how those numbers on your credit card statement really work? It’s all about credit card interest rates, and understanding them is a game-changer for your wallet! Many people find the topic a bit intimidating, but it doesn’t have to be. Let’s break down everything you need to know about credit card interest rates in a simple, straightforward way so you can make smarter financial decisions.

What Exactly Are Credit Card Interest Rates?

At its core, a credit card interest rate is the cost you pay for borrowing money. When you don’t pay your credit card balance in full each month, the outstanding amount starts accruing interest. This rate is most commonly referred to as the Annual Percentage Rate (APR). The higher your APR, the more expensive it is to carry a balance.

Think of it this way: the credit card company is lending you money, and the interest rate is their fee for that service. If you pay your balance in full before the due date, you typically won’t pay any interest on new purchases due to the ‘grace period’ offered by most cards. However, once that grace period ends, interest starts compounding daily on your remaining balance. Understanding this mechanism is key to avoiding unnecessary charges.

Factors Influencing Your Credit Card Interest Rates

Several elements play a role in determining the credit card interest rates you’re offered. It’s not a one-size-fits-all situation!

Your Credit Score

This is perhaps the biggest factor. Lenders use your credit score to assess your creditworthiness. A high credit score (e.g., 700+) usually means you’re a responsible borrower, and card issuers are more likely to offer you lower credit card interest rates. Conversely, a lower score might lead to higher rates, as you’re perceived as a higher risk.

Type of Card

Different types of credit cards come with different rate structures. Rewards cards or premium travel cards might have higher standard APRs to offset the value of their perks, while a basic low-interest card will, as the name suggests, aim for a lower rate.

Market Rates (Prime Rate)

Many credit card APRs are variable, meaning they can change. They’re often tied to the prime rate, which is influenced by the Federal Reserve. When the prime rate goes up, your variable credit card interest rates are likely to follow suit.

Card Issuer’s Policies

Each bank or credit union has its own underwriting criteria and business model, which dictates the range of interest rates they offer. It pays to shop around!

Common Types of Credit Card Interest Rates

It’s not just one rate; credit cards can have different APRs for different types of transactions. Knowing these can help you avoid surprises.

Purchase APR

This is the most common rate, applied to new purchases if you don’t pay your balance in full by the due date.

Cash Advance APR

Usually significantly higher than the purchase APR, this rate applies when you withdraw cash using your credit card. Plus, there’s often no grace period, meaning interest starts immediately.

Balance Transfer APR

This rate applies to balances you transfer from one credit card to another. Often, cards offer promotional 0% or low balance transfer APRs for an introductory period to attract new customers.

Penalty APR

If you miss a payment or violate the cardholder agreement, your issuer might apply a much higher penalty APR to your entire outstanding balance. Ouch!

Introductory APR (0% APR)

Many cards offer a 0% introductory APR for a set period (e.g., 6-18 months) on purchases, balance transfers, or both. This is a fantastic way to save on interest, but remember that the regular APR kicks in after the promotional period ends.

Smart Strategies to Manage Your Credit Card Interest Rates

Ready to take control? Here are some simple tips to keep those credit card interest rates from eating into your budget.

- Pay Your Balance in Full: This is the golden rule! If you can pay off your entire statement balance every month, you won’t incur any interest charges on new purchases.

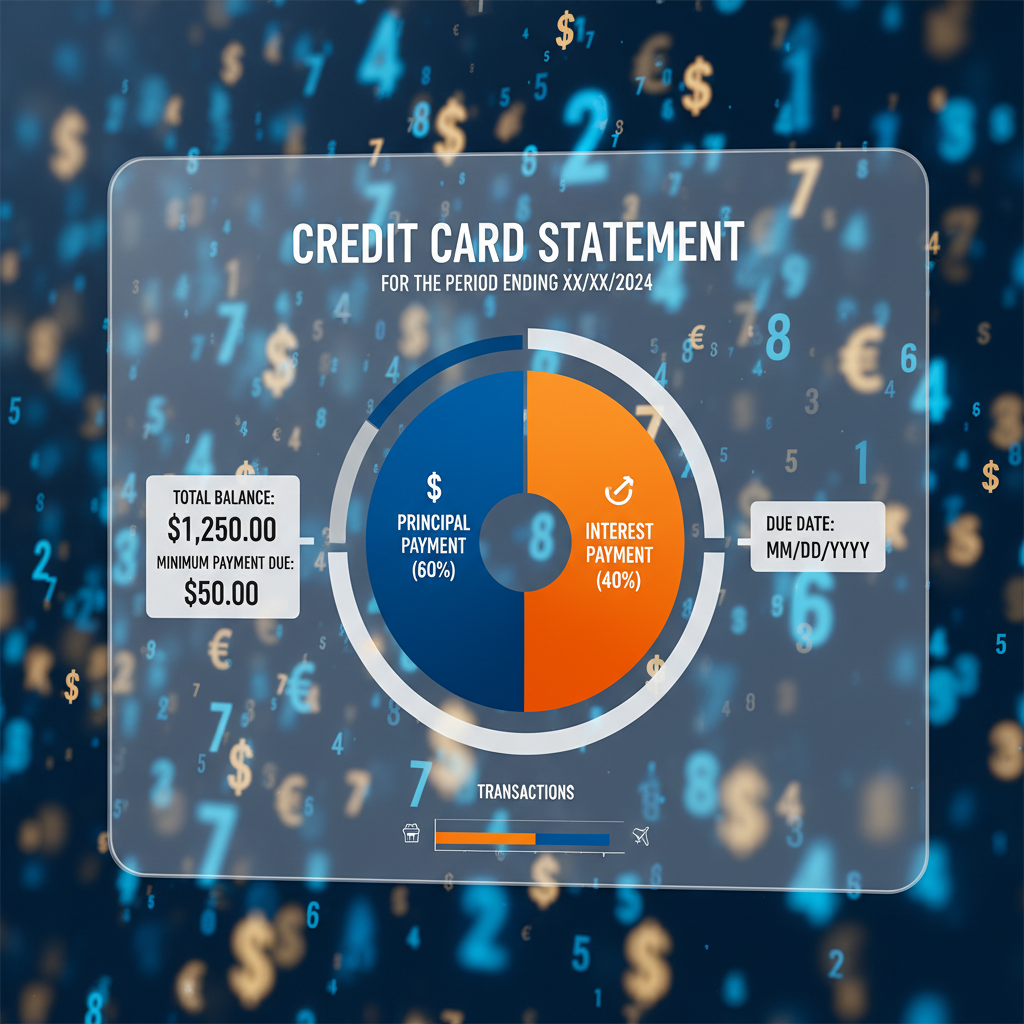

- Understand Your Statement: Always review your monthly statement to know your current APR, payment due date, and minimum payment. Don’t just pay the minimum!

- Look for 0% APR Offers: If you have a large purchase coming up or need to consolidate debt, a card with an introductory 0% APR can give you breathing room to pay it off interest-free.

- Negotiate with Your Issuer: If you have a good payment history, sometimes a quick call to your credit card company can get you a lower APR, especially if you mention competing offers.

- Consider a Balance Transfer: If you’re carrying high-interest debt, transferring it to a card with a lower balance transfer APR (especially a 0% introductory offer) can save you a lot of money in interest.

- Improve Your Credit Score: A better credit score opens the door to better credit card offers and lower credit card interest rates in the long run.

Wrapping Up

Understanding credit card interest rates isn’t just for finance experts; it’s crucial knowledge for anyone with a credit card. By knowing how they work, what influences them, and how to manage them, you’re empowering yourself to save money, avoid unnecessary debt, and build a healthier financial future. So go forth, be smart with your plastic, and keep those interest charges at bay!